Chicago Impact Investing Landscape: A Thriving Ecosystem

April 29th, 2022

By: Jackson Bruhn, University of Chicago Booth MBA, and Jessica Droste Yagan, Partner & CEO of Impact Engine

To cap off our 10th annual public impact investing showcase in Chicago this week, we released the findings from our updated analysis of the Chicago impact investing landscape (updated from a similar survey in 2020).

The Global Impact Investing Network (GIIN) defines impact investments as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. This landscape view includes all firms (1) with strategies demonstrating that impact intentionality, including ESG funds that actively engage with management, for example through proxy voting (2). Some firms have impact metrics and reporting already in place and others are actively working on or considering metrics for the future.

In total, we reached out to 56 funds this year and 34 submitted information on their work through an email or phone survey. Of those, 27 reported that they currently measure and report on impact.

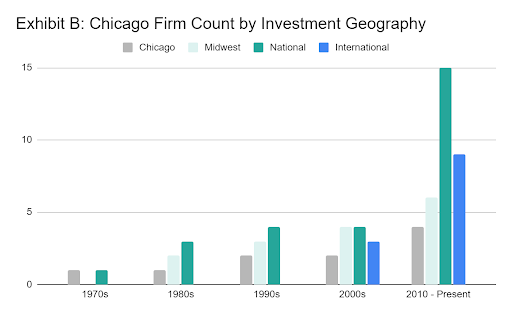

While firms with impact investing strategies have existed in Chicago since the 1970’s, growth in new funds continues to accelerate: 21 of the 34 responding firms formed or began investing with impact since 2010, and at least 16 firms have raised a new fund in the last 5 years. Furthermore, the total amount invested to date by impact investors in Chicago exceeds $14 billion (3). Other highlights include:

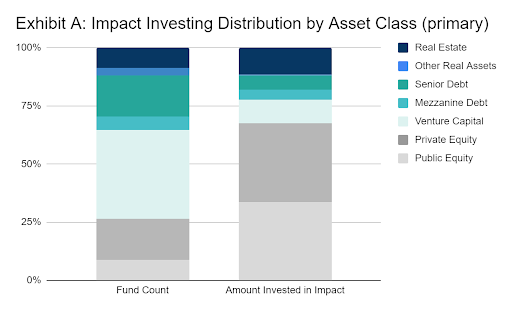

Only 9% of the firms focus on public equities, but as an asset class they collectively represent the largest proportion of capital deployed at 34%, as illustrated in Exhibit A

56% of firms are venture capital or private equity-focused and 24% are debt-focused

82% of the firms surveyed are aiming to meet or exceed market-rate financial returns

In terms of geographic focus, approximately 12% of the respondents focus solely on the greater Chicago area, while over 26% make international investments, a trend that continues to grow as illustrated in Exhibit B

While all 5 of Impact Engine’s “5 P” Impact Strategy Framework are currently deployed by over 50% of respondents, Product-based impact was the most commonly cited of the “P” strategies in the Impact Engine 5P’s framework, marked by 76% of respondents

In terms of impact domain areas, firms are placing a particular emphasis on climate change mitigation, with over 53% of respondents investing in alignment with SDG #11 (Sustainable Cities) and 42% with SDG #7 (Affordable Clean Energy)

As evidenced by the survey findings, in recent years Chicago’s impact investing ecosystem has evolved and expanded in terms of the number and scale of players involved. We welcome this momentum and look forward to witnessing the community’s continued progress!

Full List of Survey Participants

Please contact info@theimpactengine.com if you would like to be included in the next Chicago Landscape Survey.

Notes

1. This survey focused only on funds and intermediaries. While there are multiple private foundations active in impact investing, such as the John D. and Catherine T. MacArthur Foundation which has deployed over $600 million in impact investments since 1983, they were outside the scope of this exercise.

2. Given varying degrees of investor intentionality around positive environmental and social outcomes that fall underneath GIIN’s definition of impact investing, status as an “impact investor” was self-reported by participating firms.

3. This is a conservative amount, as not all firms reported the actual amount of impact investments they’ve made to date at the time of publishing.

Find more sessions on the 2022 Chicago Impact Investing Showcase page.

Information presented in this document is intended solely for informational purposes and should not be interpreted as a recommendation or offer of securities or any other financial instrument. Unless otherwise indicated, the information contained herein is current as of the date of publication of this document and is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.