Last month, Impact Engine hosted breakfast with Richard Muller of Toniic Network, a global action community for impact investors from over 22 countries. Muller shared results from the T100 Project, a multi-year study of the portfolios of Toniic Network members who are committed to investing 100% of their portfolio for impact. The T100 project came out of a need for quantitative and qualitative data as a way to inspire and enable others to accelerate their impact investing journeys as well as to demonstrate a growing market for impact products and services. To date the group has deployed $2.6 billion of $4 billion committed to impact. The study reveals new insights from over 50 portfolios and highlights the various paths towards 100% impact (to read the entire report, click here). Below we’ve shared key takeaways from the report and answer the question: what does 100% impact look like?

“Every investor has to find his or her own way, and be ready to adapt. And when you get to 100%, that is when the real journey starts.” — Toni Johnson, Heron Foundation

100% impact portfolios are achievable today.

Early findings from 51 Toniic portfolios committed to 100% impact are promising: impact investments making up an average of 64% of all portfolios, with one-third of portfolios with over 90% deployed into impact. These impact investments include 36% thematic investments (see below), 19% sustainable investments (investments integrating environmental, social and governance factors into the decision-making process) and 9% responsible investments (investments screened for conflicts or inconsistencies with personal or organizational values, codes of practice, or other impact performance criteria). For thematic investments, Toniic shows the breakdown of the following impact areas on average across portfolios, including 32% environment, 12% poverty alleviation, 9% financial system, and 7% health.

From T100 Launch Report: Insights from the Frontier of Impact Investing 2016.

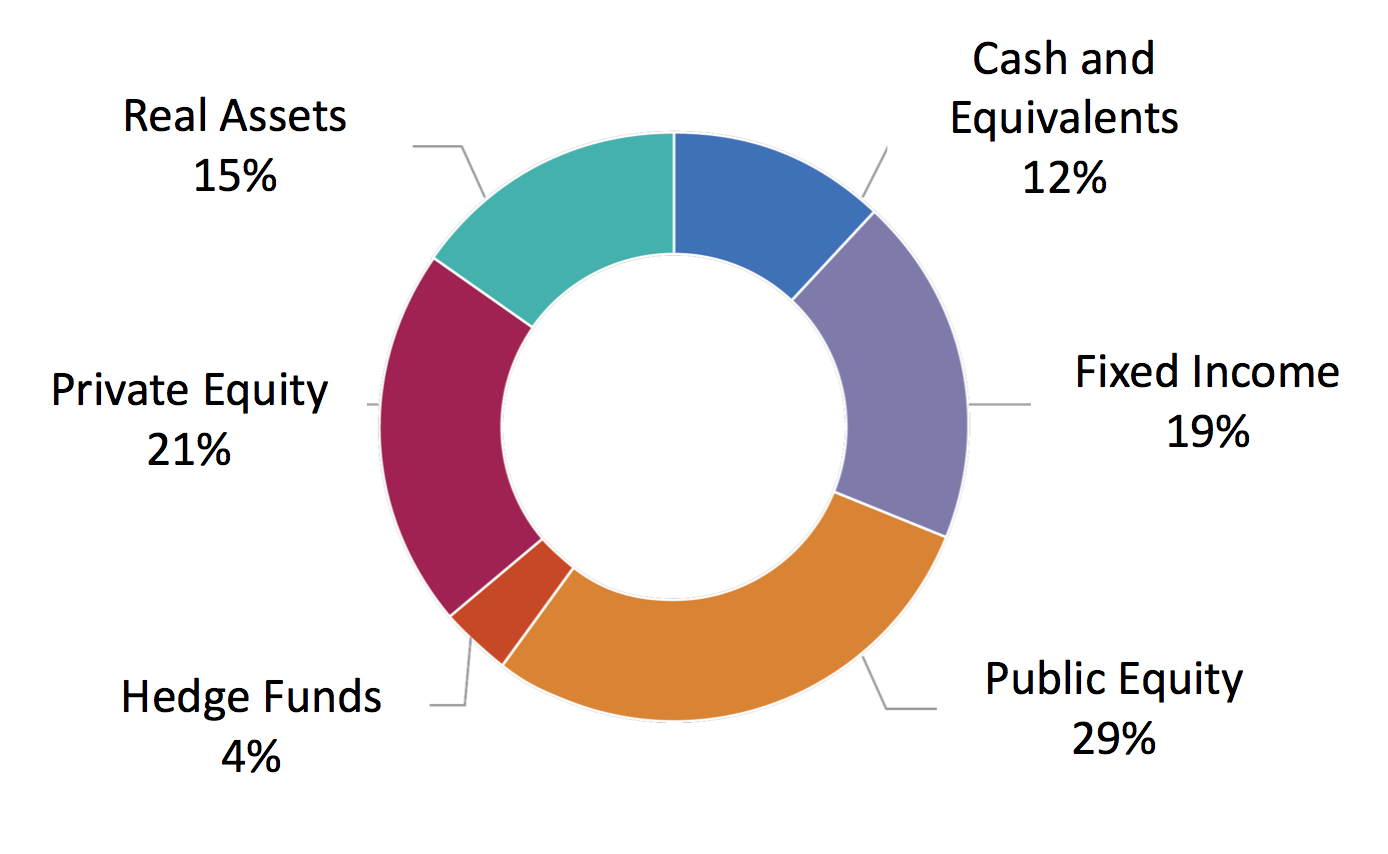

100% impact portfolios can be constructed across all asset classes.

Another takeaway is that portfolios with 100% impact can extend across asset classes. A breakdown of asset classes shows an average of 29% public equity and 21% private equity investments, as well as 19% fixed income, 15% real assets, 12% cash and equivalents, and 4% hedge funds.

From T100 Launch Report: Insights from the Frontier of Impact Investing 2016.

Impact investors are aligning to the UN Sustainable Development Goals.

Toniic has created an online directory and impact portfolio tool for investors to better understand how their investments address UN Sustainable Development Goals, seventeen goals to end poverty, protect the planet, and ensure prosperity for all as part of the United Nations’ sustainable development agenda. For each Toniic impact area and theme, the platform correlates the investment with a UN sustainable development goal. The next step is using these goals to determine impact measurement metrics for each portfolio investment. Toniic expects to roll out this impact measurement report at the end of Q2 2017.

Both impact and financial return expectations can be met.

Toniic found that most investors (83% overall) expect their portfolios to generate market rate returns, with foundations and high net worth individuals showing more willingness to accept below market rate or capital preservation strategies to generate impact (36% and 14%, respectively). In terms of performance, 83% of participants said that their portfolio met or exceeded financial objectives and 87% said their impact objectives were met.

Impact investing faces challenges…

Muller notes that investing for impact is still an uphill battle. He explains the biggest perceived roadblocks to impact investing are a shortage of quality deals across asset classes, immature impact measurement and a lack of research about the field. The T100 report strives to be the research-backed resource that interested LPs can use to transition their portfolios to impact.

But a supportive community helps.

Toniic believes there are three keys to becoming a successful impact investor. The first is finding a professional, trusted impact advisor to guide you through the process (and in case your advisor is new to impact, we’ve outlined steps to working with your financial advisor to incorporate impact into your portfolio). The second key is having a community of impact investors, friends and family who support your impact portfolio. Impact investing is not a solo journey. At Impact Engine, we know the value of investing as a community and take pride in our network of more than 120 fund investors. The final key to becoming a successful impact investor is personal engagement, another essential component of Toniic’s international community. Through events and comprehensive reports on impact investing, Toniic creates multiple opportunities for investors to engage with its network of impact investors and the portfolio companies they invest in.

While impact investing looks very different from portfolio to portfolio, Toniic has demonstrated that reaching 100% impact is achievable. In the words of Toni Johnson from the Heron Foundation, “every investor has to find his or her own way, and be ready to adapt. And when you get to 100%, that is when the real journey starts.”