By Ander Iruretagoyena and Priya Parrish

COVID-19 has exacerbated economic inequalities globally and the need for consumers to have healthy credit profiles in order to achieve economic stability and mobility. While some consumers have been able to build stronger balance sheets amidst lessened spending opportunities, that has certainly not been the case for all, especially for those underserved by the financial ecosystem. Many impact investors are aware of the need for financial inclusion strategies in emerging economies, but the size of the under/unbanked in developed economies is also notable. Take Canada, for example, where approximately 9M Canadians (close to 1/3 of adults) have non-prime credit scores (credit scores under 660). Consumers in this cohort face constraints accessing affordable credit, which can put additional pressure on already tight budgets. 53% of Canadians live paycheck-to-paycheck and 27% still don’t have enough money to meet their needs. Outside of predatory lenders, there are few options for this group of financially insecure consumers.

Solution

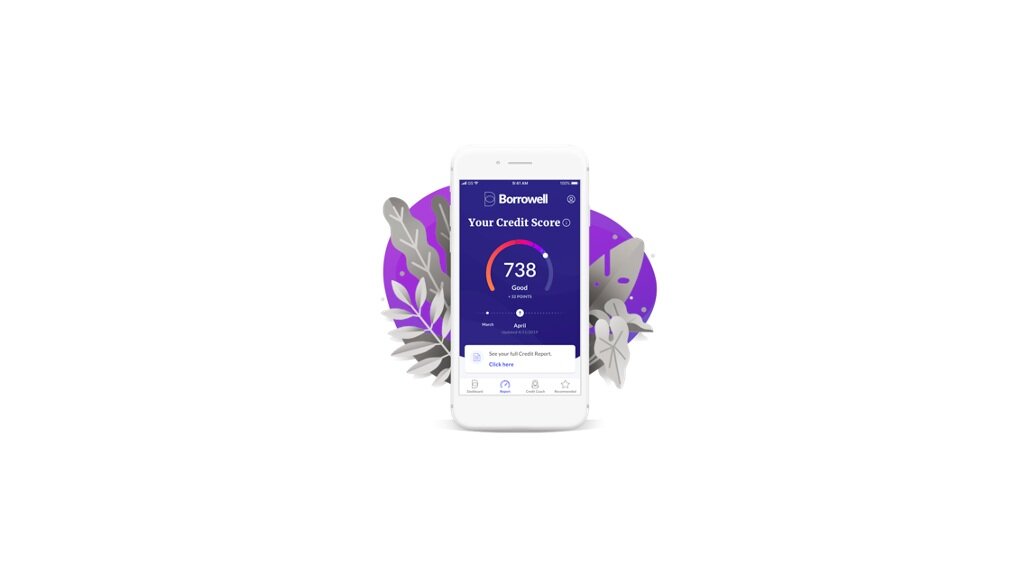

Borrowell Inc. is a leading Canadian online lending platform designed to offer personal loans and free credit scores. The company's platform utilizes free credit scores and monitoring services to make AI-powered product recommendations, including money management solutions, bill alerts, and predictive cash advances. Users benefit from access to low-interest loans and financial education tools while financial partners benefit from high intent pre-qualified leads. Borrowell aims to be the go-to platform for anyone looking to see their credit reports, gain financial education, and have access to budgeting and capital products aimed at improving financial stability and mobility. This should make a difference for the more than 25% of Canadians who feel overwhelmed by debt.

Why We Invested

Borrowell’s acquisition of Refresh Financial (a fintech company enabling credit rehabilitation through its credit builder loan and secured credit card products) represents a compelling opportunity for the company. With the funding in place to finance this acquisition, Borrowell will be able to expand its product line and build out a multi-product strategy that can produce stronger financial stability for their target customer while increasing their lifetime value. Upon close, the company will immediately realize gains through cross-selling opportunities, improved unit economics related to decreased loan origination costs, and significant synergies. Having a strong first-mover advantage, Borrowell is the clear leader in the large but relatively uncompetitive (when compared to the United States) Canadian financial origination market. The Impact Engine team has conviction in Borrowell’s management team and their systematic and comprehensive plan for integration that includes continued focus on driving measurable improvements to their customer’s financial health.

ImpacT

The combined entity will target the underserved subprime credit population. 53% of Borrowell users have credit scores of less than 659 and the average starting credit score of a Refresh Financial client is 500. However, through engagement with the Borrowell platform, users are able to improve their credit score by a demonstrated 171+ points in 24 months. Borrowell has already demonstrated its ability to establish financial prosperity for its user base through raising the credit scores of its users, lowering their cost of borrowing, making budgeting more manageable, and increasing their savings. This acquisition and round of funding will amplify that impact by enabling the company to serve more non-prime credit seekers and to provide a broader suite of products and services that meet the diverse needs of each user.

Want more updates on Impact Engine’s latest investments? Sign up for our newsletter, sent to your inbox each month.