By Rahul Bhide

The retirement crisis in America is no longer looming—it's here. With over 10,000 baby boomers turning 65 every day and nearly half of U.S. households at risk of not being able to maintain their standard of living in retirement, the need for innovative solutions has never been greater. That’s why we invested in Retirable, a company redefining how people approach financial wellbeing in retirement. By combining personalized advice, accessible digital tools, and a mission-driven approach, Retirable is tackling one of the most urgent and underserved challenges in financial wellness.

Solution

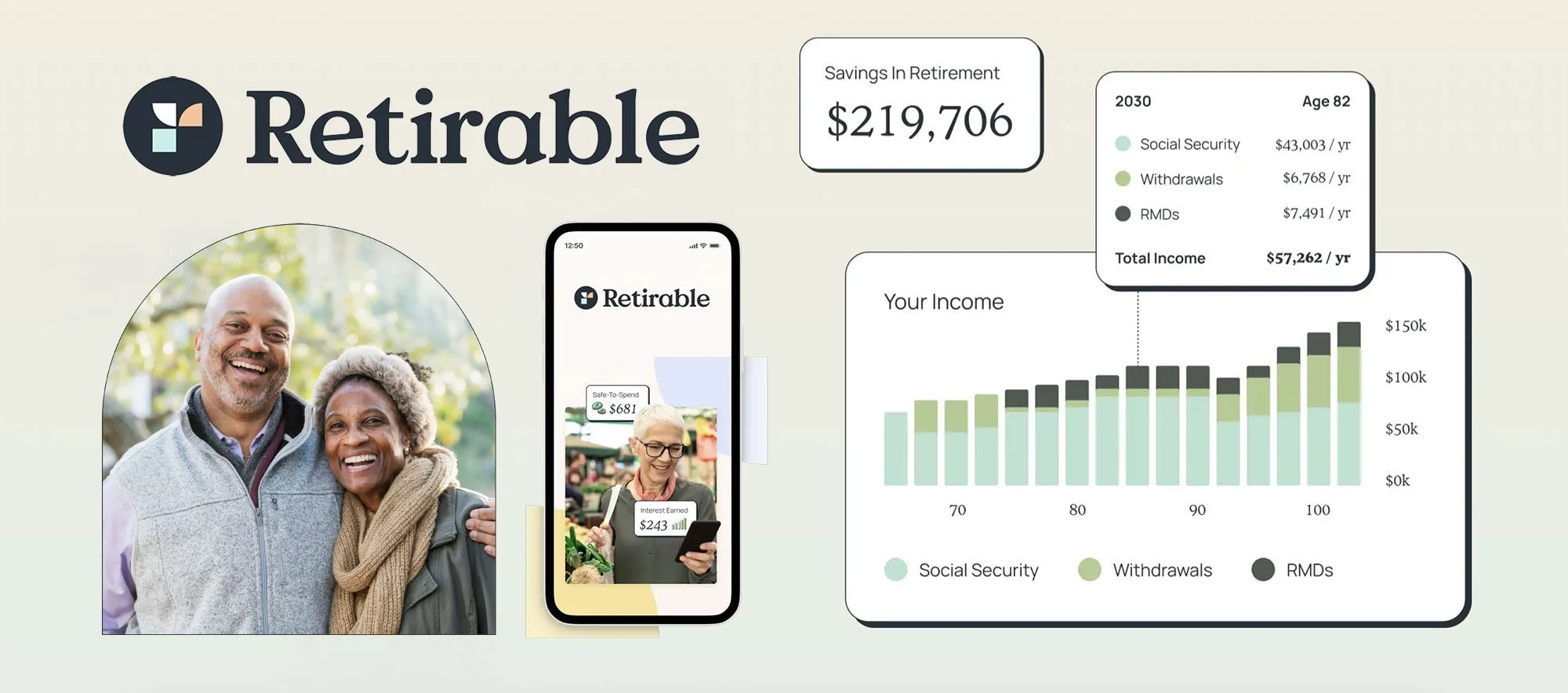

Retirable is a retirement planning, investing and spending solution with the ongoing care of a fiduciary advisor. The company works to build financial plans for older Americans, helps them develop a 'safe-to-spend' number, manages their assets (like a 401k/IRA, etc.), and issues a monthly “paycheck”. There are three main aspects of the solution:

Access to human advisors: Clients work with an advisor to plan their retirement, including required cash flows, timing, and goals. Retirable’s AI-enabled technology platform helps advisors do this. After becoming a client, their human advisor meets with them at least once a year to revisit the plan.

Managing retirement accounts: After someone becomes a client, Retirable begins managing their retirement accounts (401Ks, IRAs, brokerage accounts) and segments the assets into three buckets; a year’s income in high-interest checking, five years’ in a synthetic personalized bond ladder, and the remainder of assets in low-cost ETFs. The bond ladder is refilled using investment gains; in down years, the bond ladder is drawn upon. All of this automated rebalancing is done by the Retirable technology platform.

Issuing monthly paychecks: Based on the planning done by the client and the advisor, Retirable issues a monthly “paycheck” to clients. This is also automated by the Retirable platform, enabling clients to continue their financial life that they used to have when collecting a paycheck.

Why We Invested

The Retirable team, led by Tyler End and Ian Yamey, have been deeply embedded in this product space and distribution channel for the majority of their careers, and they’ve built a product offering that is appealing to retirees who have been traditionally underserved and deprioritized by current retirement advisors and solutions. We’re excited to back the team to continue to scale the company, deploy AI to enable advisors to serve customers more efficiently at scale, and support Americans in a critical period of their financial lives.

Impact

Retirable serves mass-market American households, a core focus of our Economic Opportunity strategy. 63% of their customers have never worked with a financial planner before, and most of the balance have relied upon a friend or family member to set up a plan for them. Access to financial planning has been shown to drive more resilient and worry-free retirement strategies; Retirable’s model is designed to support clients during periods of market volatility, aimed at helping them stay invested and avoid reactive decision-making.

There is a well-documented increase in stress and lowered mental wellbeing closer to retirement driven by uncertainty and anxiety with finances that can also impact physical health.

References to products or services offered by portfolio companies are for informational purposes only and are not endorsements or recommendations for use.