This overview of what we’ve seen in economic empowerment is the first of what will be a four-part monthly series where we will cover each of our focus areas in turn.

What Does 100% Impact Look Like?

Last month, Impact Engine hosted breakfast with Richard Muller of Toniic Network, a global action community for impact investors from over 22 countries. Muller shared results from the T100 Project, a multi-year study of the portfolios of Toniic Network members who are committed to investing 100% of their portfolio for impact. The T100 project came out of a need for quantitative and qualitative data as a way to inspire and enable others to accelerate their impact investing journeys as well as to demonstrate a growing market for impact products and services. To date the group has deployed $2.6 billion of $4 billion committed to impact. The study reveals new insights from over 50 portfolios and highlights the various paths towards 100% impact (to read the entire report, click here). Below we’ve shared key takeaways from the report and answer the question: what does 100% impact look like?

“Every investor has to find his or her own way, and be ready to adapt. And when you get to 100%, that is when the real journey starts.” — Toni Johnson, Heron Foundation

100% impact portfolios are achievable today.

Early findings from 51 Toniic portfolios committed to 100% impact are promising: impact investments making up an average of 64% of all portfolios, with one-third of portfolios with over 90% deployed into impact. These impact investments include 36% thematic investments (see below), 19% sustainable investments (investments integrating environmental, social and governance factors into the decision-making process) and 9% responsible investments (investments screened for conflicts or inconsistencies with personal or organizational values, codes of practice, or other impact performance criteria). For thematic investments, Toniic shows the breakdown of the following impact areas on average across portfolios, including 32% environment, 12% poverty alleviation, 9% financial system, and 7% health.

From T100 Launch Report: Insights from the Frontier of Impact Investing 2016.

100% impact portfolios can be constructed across all asset classes.

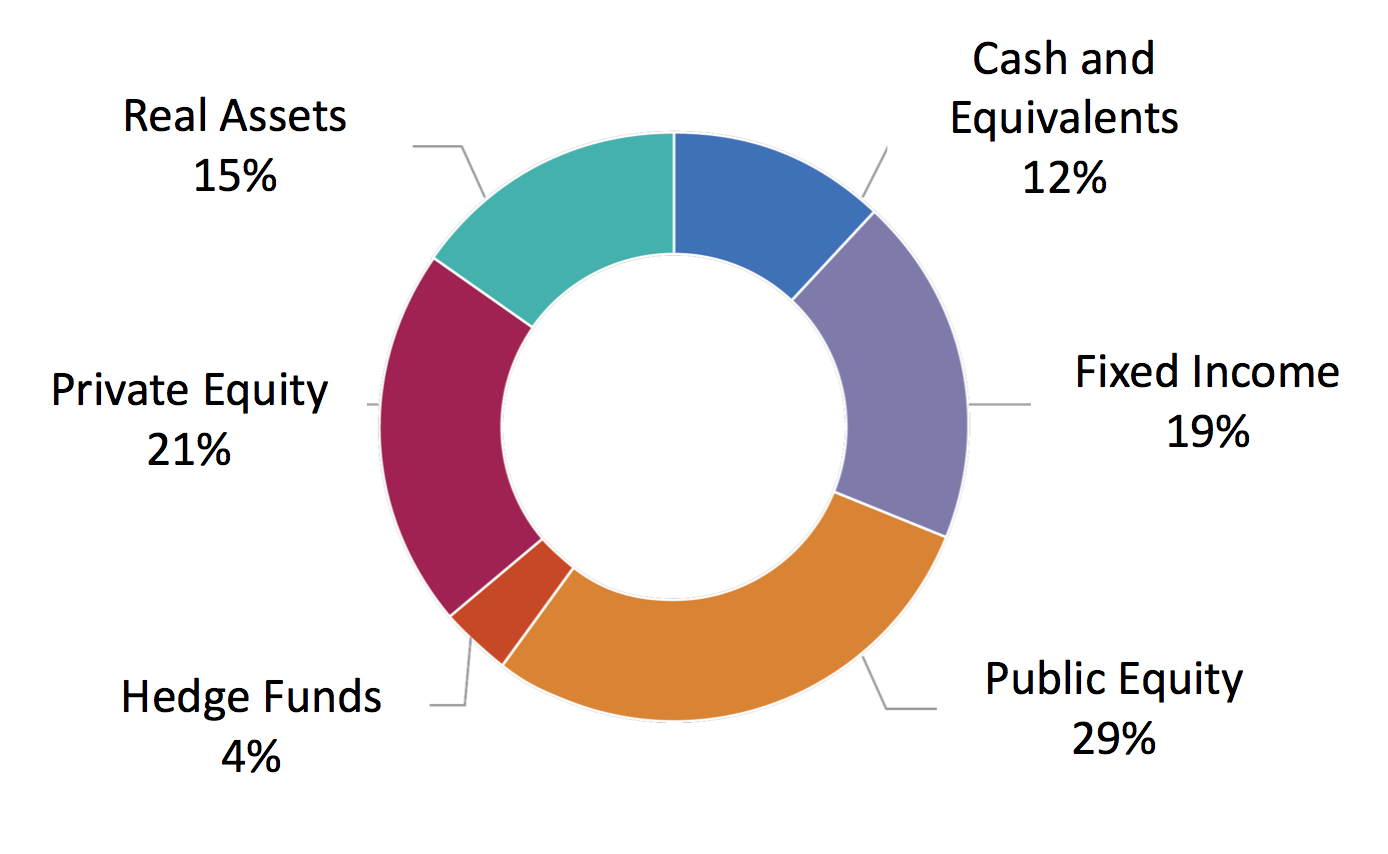

Another takeaway is that portfolios with 100% impact can extend across asset classes. A breakdown of asset classes shows an average of 29% public equity and 21% private equity investments, as well as 19% fixed income, 15% real assets, 12% cash and equivalents, and 4% hedge funds.

From T100 Launch Report: Insights from the Frontier of Impact Investing 2016.

Impact investors are aligning to the UN Sustainable Development Goals.

Toniic has created an online directory and impact portfolio tool for investors to better understand how their investments address UN Sustainable Development Goals, seventeen goals to end poverty, protect the planet, and ensure prosperity for all as part of the United Nations’ sustainable development agenda. For each Toniic impact area and theme, the platform correlates the investment with a UN sustainable development goal. The next step is using these goals to determine impact measurement metrics for each portfolio investment. Toniic expects to roll out this impact measurement report at the end of Q2 2017.

Both impact and financial return expectations can be met.

Toniic found that most investors (83% overall) expect their portfolios to generate market rate returns, with foundations and high net worth individuals showing more willingness to accept below market rate or capital preservation strategies to generate impact (36% and 14%, respectively). In terms of performance, 83% of participants said that their portfolio met or exceeded financial objectives and 87% said their impact objectives were met.

Impact investing faces challenges…

Muller notes that investing for impact is still an uphill battle. He explains the biggest perceived roadblocks to impact investing are a shortage of quality deals across asset classes, immature impact measurement and a lack of research about the field. The T100 report strives to be the research-backed resource that interested LPs can use to transition their portfolios to impact.

But a supportive community helps.

Toniic believes there are three keys to becoming a successful impact investor. The first is finding a professional, trusted impact advisor to guide you through the process (and in case your advisor is new to impact, we’ve outlined steps to working with your financial advisor to incorporate impact into your portfolio). The second key is having a community of impact investors, friends and family who support your impact portfolio. Impact investing is not a solo journey. At Impact Engine, we know the value of investing as a community and take pride in our network of more than 120 fund investors. The final key to becoming a successful impact investor is personal engagement, another essential component of Toniic’s international community. Through events and comprehensive reports on impact investing, Toniic creates multiple opportunities for investors to engage with its network of impact investors and the portfolio companies they invest in.

While impact investing looks very different from portfolio to portfolio, Toniic has demonstrated that reaching 100% impact is achievable. In the words of Toni Johnson from the Heron Foundation, “every investor has to find his or her own way, and be ready to adapt. And when you get to 100%, that is when the real journey starts.”

Chicago: The Homegrown Impact Investing Hub

This article originally appeared in Social Innovations Journal: Issue 33 Chicago Edition on April 24, 2017.

By Jessica Droste Yagan & Tasha Seitz

From early conversations in 2011 to the deployment of our $10 million impact fund today, Impact Engine has grown and evolved in parallel with the companies in our portfolio driving innovation and impact. Today, we operate as a venture fund that invests financial and human capital in early-stage, for-profit technology businesses improving education, health, economic empowerment and resource efficiency. Our fund is backed by a group of engaged, like-minded impact investors who support our expanding portfolio of impact companies. Our strength is in our dedicated, supportive and engaged community of impact entrepreneurs and impact investors in Chicago. We’ve shared our journey here in the hopes that other communities may learn from our path.

“We have approached this journey with a learning mindset, an openness to change, and a lot of scrappiness.”

At Impact Engine, we have worked over the past several years to build a market for impact investing around these two firm beliefs: (1) there are many talented entrepreneurs using for-profit business models to tackle social and environmental challenges that are also large, profitable market opportunities, and (2) there are a growing number of individuals that are realizing the power of their investment dollars and seeking to direct that power toward positive social and environmental outcomes at scale. We have approached this journey with a learning mindset, an openness to change, and a lot of scrappiness.

Our founders, Linda Darragh, then Director of Entrepreneurship at the University of Chicago’s Booth School of Business, and Jamie Jones, who was leading the social entrepreneurship program at Northwestern University’s Kellogg School of Management, saw a need in the market and stepped up to fill it. Through their work with MBA students, Darragh and Jones observed that students looking to launch businesses with impact were often deterred by the lack of access to capital and mentorship. They also knew angel investors who were interested in the concept of impact investing, but didn’t see any investable opportunities. In 2011, the two decided to bring together investors, entrepreneurs and philanthropists throughout Chicago for a series of conversations, asking the question, “What can we do to fill the gap in impact investing in Chicago?” The answer was a twelve-week startup accelerator program called Impact Engine.

In retrospect, an accelerator was an ideal starting point. Unlike other groups who were “all talk” about impact investing, the Impact Engine accelerator involved real entrepreneurs, real investors, and real investments. Yet, it was a manageable size to test interest in the community. It was also perfect for entrepreneurs looking to get started on the right path, since critical early-stage financial and human capital can make all the difference in the very early stages of a company and Chicago did not have a lot of early-stage resources at that time.

Launching an accelerator was no small undertaking. First, Darragh and Jones had to find the right leadership. Luckily, they found and convinced Chuck Templeton, founder of OpenTable and successful Chicago-based angel investor, to take the lead as Impact Engine’s first Managing Director. Templeton’s talent as an investor and mentor, combined with his reputation in the Chicago community, made him the ideal leader to pull together the entrepreneurs, mentors, investors and volunteers that it takes to run a successful accelerator. With the addition of board members Tasha Seitz, General Partner at JK&B Capital, and Dennis Barsema, serial entrepreneur and instructor at Northern Illinois University College of Business, the accelerator was ready to launch.

Attendees at our Demo Day event, January 17, 2014.

After successfully raising the first fund of $525,000 from 22 local, individual investors to test the concept for the first cohort, the team put out the call for applications in May 2012. The accelerator was modeled after Excelerate Labs, a successful Chicago-based accelerator program focused on technology startups. Each company selected would receive $25,000 in seed funding, as well as mentorship, training, legal advice, tax consulting, marketing, sales strategies and a workspace at 1871, the largest tech hub in Chicago, for twelve weeks. In exchange, Impact Engine received a seven percent stake in each company. Eight companies were selected and completed the rigorous three-month program, and in December 2012, they presented at our first Demo Day to a crowd of more than 300 outside investors and community supporters.

“Finally, investors were opening their eyes to new investment possibilities. A local market for impact investing was born and ready to grow.”

The first accelerator was a major success: companies got connected to additional support in the form of customers, partners, investors and mentors, and investors were introduced to companies with potential to make a profit while also making a positive social or environmental impact. Finally, investors were opening their eyes to new investment possibilities. A local market for impact investing was born and ready to grow.

Over the next two years, we repeated and improved upon the accelerator model, running two more funds as accelerator cohorts in 2013 and 2014. By the end of the third year, we had invested in 23 companies that were employing 180 people and had raised $54.3 million in capital on top of our accelerator investments. Early success stories from our first class included ThinkCERCA and Piece & Co. ThinkCERCA, a web-based platform that gives teachers the tools to create and deliver personalized critical thinking instruction, is now serving over 310,000 students in 210 schools and helping improve critical reading skills by 1.5 to 2.5 grade levels each year. Piece & Co. is a marketplace that connects retail brands with artisans in the developing world. They have worked with notable brands like Nike, Tory Burch, Nordstrom and Banana Republic and have provided $640,000 to artisans in sixteen countries in the developing world. On the other side of the market, Impact Engine had engaged hundreds of mentors providing human capital to the companies, and more than 85 individuals became involved financially, making at least one investment in Impact Engine or its companies. It was clear that the market for impact investing in Chicago was thriving and had more potential.

As we began to grow and change, so did our team. Templeton stepped down as Managing Director in 2014 and joined Darragh and Jones on the Investment Committee. In his place, Jessica Droste Yagan and Tasha Seitz stepped in to tackle the question of how to evolve Impact Engine to meet the growing demand from investors and entrepreneurs, and it was decided that the next step was to become a seed-stage impact venture fund.

The decision to shift from accelerator to seed fund was driven by two factors. First, while there were a growing number of accredited investors interested in aligning profit and social return, early-stage investing requires a knowledge base and time commitment that many lacked, so entrepreneurs struggled to get checks written. Second, support systems for startup entrepreneurs were proliferating in Chicago and Impact Engine’s advantage was in its network of mentors and investors and its focus on impact, not in its accelerator curriculum. We thought more capital could be engaged and entrepreneurs more effectively supported if we took an active role and moved the capital on behalf of our investors through a fund structure. In 2015, we began raising a seed fund from individual investors, selling not only a stake in the fund, but also access to a strong community of Chicago-based investors who were on a similar impact investing journey.

“Our journey to grow the impact investing market in Chicago has taken many turns, but the constant priority has been supporting impact entrepreneurs and investors.”

In June 2016, we announced the close of a $10 million impact fund that invests in seed-stage companies with products that directly improve education, health, economic empowerment or resource efficiency. The fund maintains the spirit of our accelerator roots with a focus on deep investment of human and financial capital, but it’s customized, not delivered through a formalized program to a cohort of companies. The other notably unique character of the fund is the level of our engagement with investors through facilitation of co-investment opportunities as well as education and community-building events (e.g. an impact investment bootcamp with Forefront and Arabella Advisors, a fireside chat with Jean Case of the Case Foundation, and “Anatomy of a Deal” where investors learn more about the Impact Engine due diligence process).

Our journey to grow the impact investing market in Chicago has taken many turns over the years, but the constant priority has been supporting impact entrepreneurs and investors. Through our accelerator funds and our current seed fund, we’ve invested in more than thirty companies across the country and are actively supporting them and supporting their growth. Our goal is to continue to create impact within our growing portfolio and pave the way as a market maker and thought leader in the impact investing world. We plan on growing our network of connected investors and sharing what we’ve learned in the space with a broader audience of investors. We remain committed to the Chicago social impact ecosystem and will continue to use our platform to showcase other social impact funds investing in Chicago and the businesses tackling the city’s most pressing issues. Over the next five years, we look forward to bigger investments, greater impact and more opportunities to share and learn in the impact investing space.

Jessica Droste Yagan is the Chief Executive Officer (CEO) of Impact Engine & Tasha Seitz is the Chief Investment Officer (CIO) of Impact Engine.